Different stocks will have different levels of strength in their peaks. - The most common parameter to change is the. - The check boxes are self explanatory for which labels they turn on and off on the plot. 3 bars will be more robust but can miss short duration peaks. 2 bars will be able to detect small peaks but create more “false” peaks that may not be meaningful. only 2 options for this setting: 2 or 3 bars. 1-bar-back up relative to 2-bars-back (look back = 1), c) 2-bars-back up relative to 3-bars-back (lookback = 2), and d) 3-bars-back up relative to 4-bars-back (lookback = 3). For example, a top is detected like this: current-bar down relative to the 1-bar-back, - defines how many bars back the peak detector looks to determine if a peak has occurred. This affects the purple line in the indicator. - defines how far back the SMA averages the cRSI. Just increment it up/down to see the effect. - Increase to length that amount of time a band (upper/lower) stays high/low after a peak. - defines how far back the WMA averages price. Uncheck this box and it will use the regular WMA (no volume). - If the equity does not have volume, then the VWMA will not show up.

Previous motivewave version code#

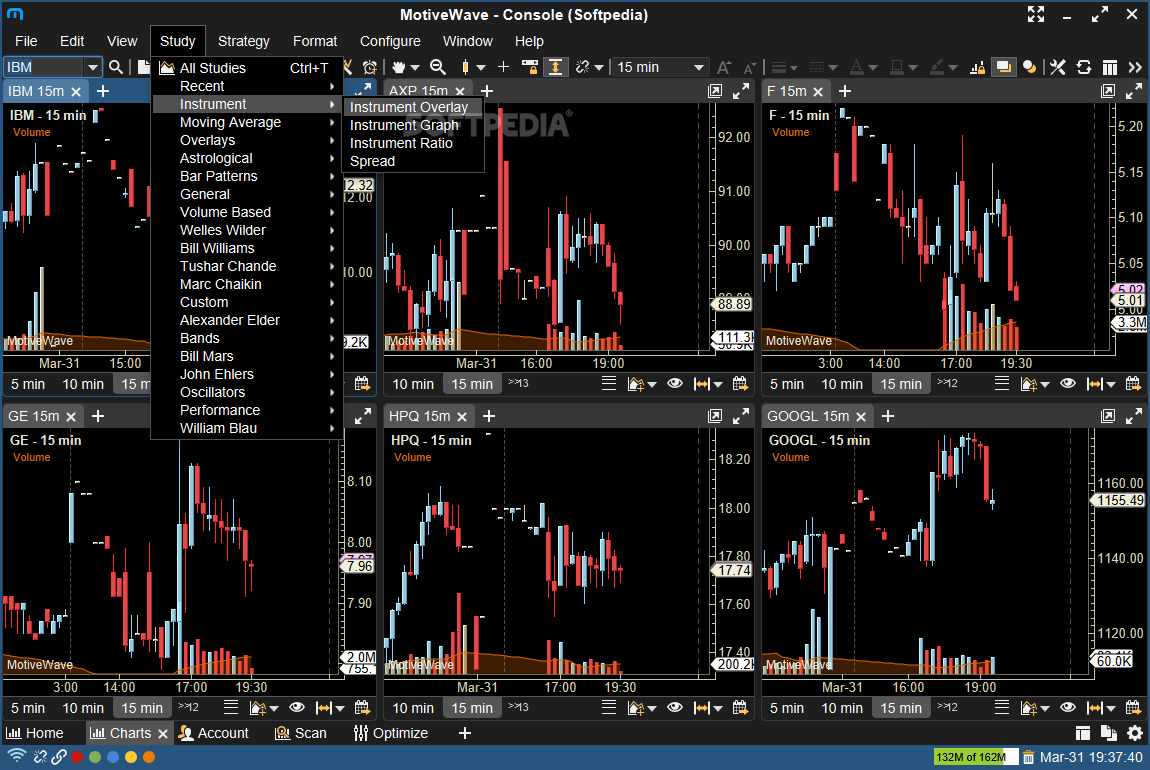

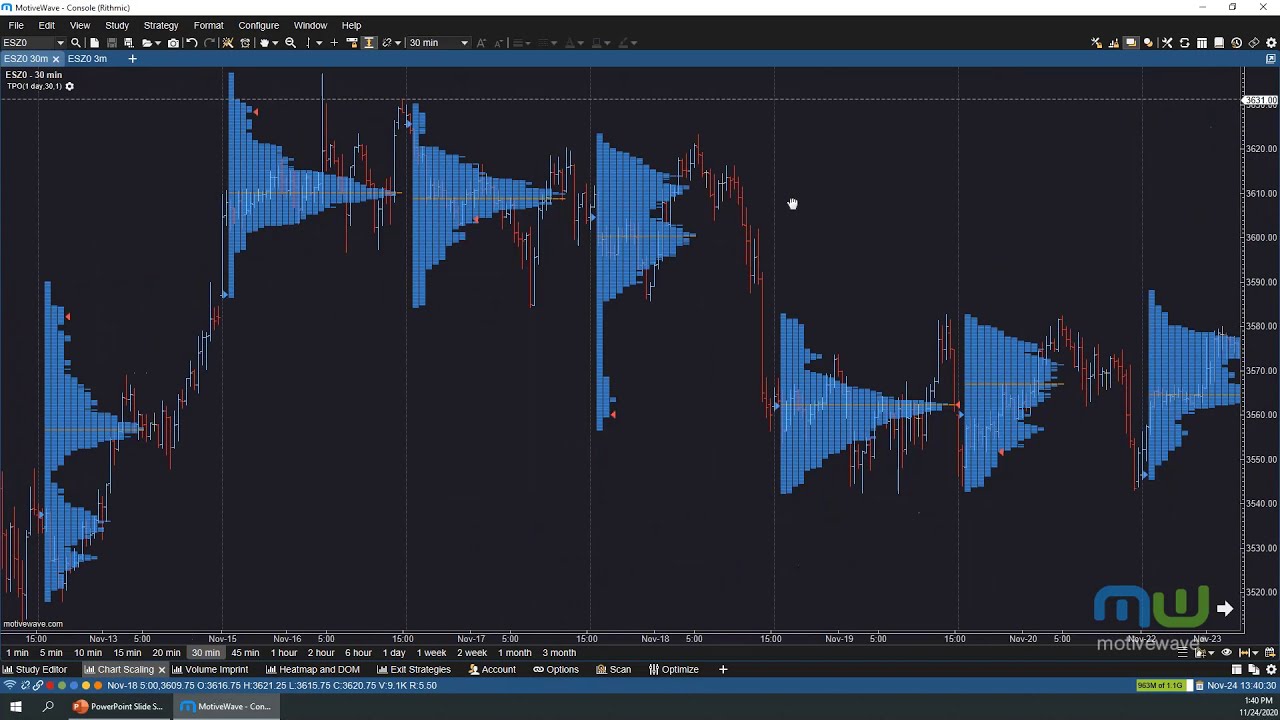

1) Volume Weighted Moving Average (VWMA): This is a “hidden strategy” feature implemented that will display the high-low bands of the VWMA on the price chart if run the code using “overlay = true”. I make no promises or guarantees about how good it is as a strategy, but it gives you some code and ideas to work with. The buy/sell code is at the end and just needs to be uncommented. strategy("cRSI + Waves Strategy with VWMA overlay", overlay=overlay) change it from study to something like. Just copy and past it into a new strategy script and just I use this code for both my indicator and for trading strategy. As a bit of an Easter Egg, this code can be tweaked and run as a strategy to get buy/sell signals. very well "on average." However, my implementation has minimal latency as peaks (tops/bottoms) only require one bar to detect. Perfect timing is not possible strictly with these indicators, but they do work That means they tend to trigger right after key events. There is a latency issue with an indicator like this that is based on moving averages. You will want to give the alert a good name that includes the ticker name and time frame, for example "SPX 1D: Bull - cRSI above WMA" drop down below that select the alert that you want (such as: Bull - cRSI Above WMA). Go to the TradingView "Alerts" tab (click the alarm clock icon) -> Create Alert (alarm clock with a +) -> Change the first condition drop down to "Cyclic Smoothed RSI with Motive-Corrective Wave Indicator" -> in the Select the equity you want (such as: SPX) and the desired timeframe (such as: D). 4) I have also added "alert conditions" for most of the key events. I was not able to replicate the TradingView style of drawing a line from peak to peak, but for this indicator I think in the end it makes the chart cleaner. 3) My own divergence indicator for bull, hidden bull, bear, and hidden bear.

Strong waves have a peak above the cRSI upper band and weak waves have a peak below the upper band. Motive waves are identified as s (strong) and w (weak). Once and a while you could actually see G and F a second time. F and G waves are not technically Elliot Waves, but the way I detect waves it is really hard Corrective waves are indicated A, B, C, D, E, F, G. 2) An attempt to detect the motive (impulse) and corrective and waves.

This is then is used to color the region between the upper and lower cRSI bands (green above, red below). This is very helpful in determining when the equity switches from bullish to bearish, which can be used to determine buy/sell points. 1) A Weighted Moving Average (WMA) to track the general trend of the cRSI signal. See below for more info on the benefits to the cRSI. © This indicator uses the cyclic smoothed Relative Strength Index (cRSI) instead of the traditional Relative Strength Index (RSI).

Previous motivewave version license#

This source code is subject to the terms of the Mozilla Public License 2.0 at But I would like to have the indicator based on ThinkScript. It provides an effective way find the stock bottoms. I would like to know whether there is ThinkOrSwim version of cRSI + Waves Indicator with VWMA overlay.

0 kommentar(er)

0 kommentar(er)